Brought to you by - Competition ZENITH

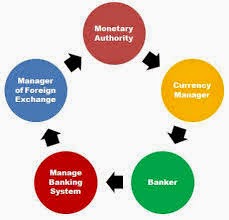

Traditional Central Banking Functions

The Reserve Bank of India discharges all those functions which are performed by a central bank. Among these the more important functions are as follows:

1. Monopoly of Note Issue:

Under Section 22 of the Reserve Bank of India Act, the Bank has the sole right to issue bank notes of all denomination. The distribution of one rupee notes and coins and small coins all over the country is undertaken by the Reserve Bank as agent of the Government. The Reserve Bank has a separate Issue Department which is entrusted with the issue of currency notes. The Reserve Bank of India is required to maintain gold and foreign exchange reserves of Rs. 200 crores, of which at least Rs. 115 crores should be in gold. The system as it exists today is known as the Minimum Reserve System.

2. Banker to the Government:

The Reserve Bank of India serves as a banker to the Central Government and the State Governments. It is its obligatory function as a central bank. It provides a full range of banking services to these Governments, such as:

(a) Maintaining and operating of deposit accounts of the Central and State Government.

(b) Receipts and collection of payments to the Central and State Government.

(c) Making payments on behalf of the Central and State Government.

(d) Transfer of funds and remittance facilities of the Central and State Governments.

(e) Managing the public debt and issue of new loans and Treasury Bills of the Central Government.

(f) Providing ways and means advances to the Central and State governments to bridge the interval between expenditure and flow of receipts of revenue.

(g) Advising the Central/State governments on financial matters, such as the quantum, timing and terms of issue of new loans. For ensuring the success of government loan operations, the RBI plays an active role in the gilt-edged market.

(h) The bank also tenders advice to the government on policies concerning banking and financial issues, planning as resource mobilisation. The Government of India consults the Reserve Bank on certain aspects of formulation of the country’s Five Year Plans.

(i) The Reserve Bank represents the Government of India as member of the International Monetary Fund and World Bank.

|

| Functions of RBI |

3. Banker’s Bank:

The Reserve Bank has the right of controlling the activities of the banks in the country. All the commercial banks, co-operative banks and foreign banks in the country have to open accounts with the bank and are required to keep a certain portion of their deposits as reserves with the Reserve Bank.

4. Lender of the Last Resort:

The scheduled banks can borrow from the Reserve Bank on the basis of eligible securities. They can also get the bills of exchange rediscounted. The Reserve Bank acts as the clearing house of all the banks. It adjusts the debits and credits of various banks by merely passing the book entries.

5. Credit Control:

The Reserve Bank of India is the controller of credit, i.e., it has the power to influence the volume of credit created by bank in India. It can do so through changing the bank rate or through open market operation. The Reserve Bank of India is armed with many more powers to control the Indian money market.

Every bank has to get a licence from the Reserve Bank of India to do banking business within India. The licence can be cancelled by the Reserve Bank if certain stipulated conditions are not fulfilled. Every bank will have to get the permission of the Reserve Bank before it can open a new branch. Each scheduled bank must send a weekly return to the Reserve Bank showing, in detail, its assets and liabilities. This power of the bank to call for information is also intended to give it effective control of the credit system. The Reserve Bank has also the power to inspect the accounts of any commercial bank.

As supreme banking authority in the country, the Reserve Bank of India, therefore, has the following powers:

(a) It holds the cash reserves of all the scheduled bank.

(b) It controls the credit operation of banks through quantitative and qualitative controls.

(c) It controls the banking system through the system of licensing, inspection and calling for information.

(d) It acts as the lender of the last resort by providing rediscount facilities to scheduled banks.

|

| Raghuram Rajan(RBI governer) |

6. Custodian of Foreign Exchange Reserves:

The Reserve Bank has the responsibility of maintaining the external value of the rupee. There is centralisation of the entire foreign exchange reserves of the country with the Reserve Bank to avoid fluctuations in the exchange rate.The RBI has the authority to enter into foreign exchange transactions both on its own account and on behalf of government. The bank is also empowered to buy and sell foreign exchange from and to scheduled banks in amounts of not less than the equivalent of Rs. 1 lakh.

Comments

Post a Comment